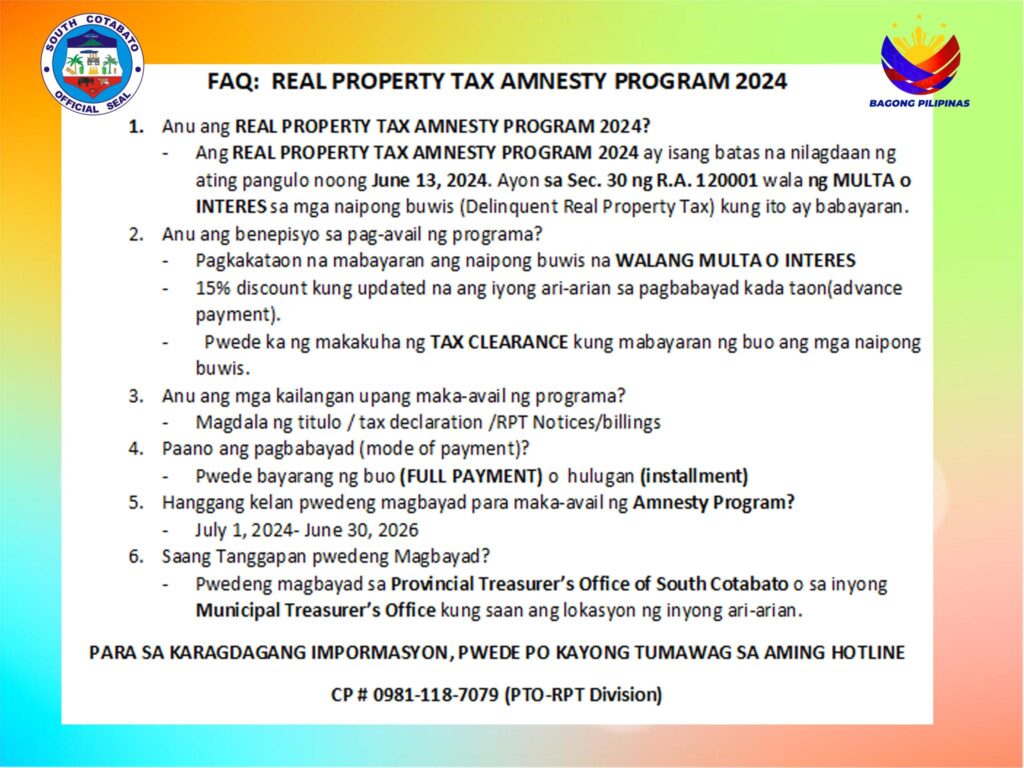

The Provincial Government of South Cotabato, through the Office of the Provincial Treasurer, announces the continued implementation of the Real Property Tax Amnesty Program 2024, in accordance with Republic Act No. 12001 (RPVARA), signed into law on June 13, 2024.

Under the amnesty program, penalties, surcharges, and interest on delinquent real property taxes are fully waived, providing a crucial opportunity for property owners to settle their obligations without additional financial burdens. The amnesty period covers payments made from July 1, 2024 to June 30, 2026.

Property owners who avail of the program can benefit from a 100% waiver of penalties and interest, a 15% discount for updated accounts that pay in advance, and the issuance of Tax Clearance upon full payment. Payments may be made in full or through installment basis.

To apply, property owners are advised to bring any of the following documents: land title, tax declaration, or Real Property Tax (RPT) billing statements. Payments may be processed at the Provincial Treasurer’s Office of South Cotabato or at the respective Municipal Treasurer’s Office in the area where the property is located.

In a related announcement, the Office of the Provincial Treasurer has also issued a Notice of Delinquency for unpaid real property taxes covering the period of January to March 2025. Based on official records, some properties remain with unsettled dues. As stipulated, personal property may be distrained to enforce payment, and if the taxes, along with applicable surcharges and penalties, are not paid before the end of the year, the delinquent real property will be sold at public auction. The property title will be transferred to the purchaser, subject to the right of the delinquent owner or any party with legal interest to redeem the property within one year from the date of sale.

Taxpayers who have already paid are advised to disregard the notice. Those who need assistance or clarification may contact the Provincial Treasurer’s Office – RPT Division through the official hotline: +63981-118-7079.

This initiative is part of the government’s continuing effort to promote tax compliance, ease the burden on taxpayers, and enhance local revenue collection under the Bagong Pilipinas governance agenda.