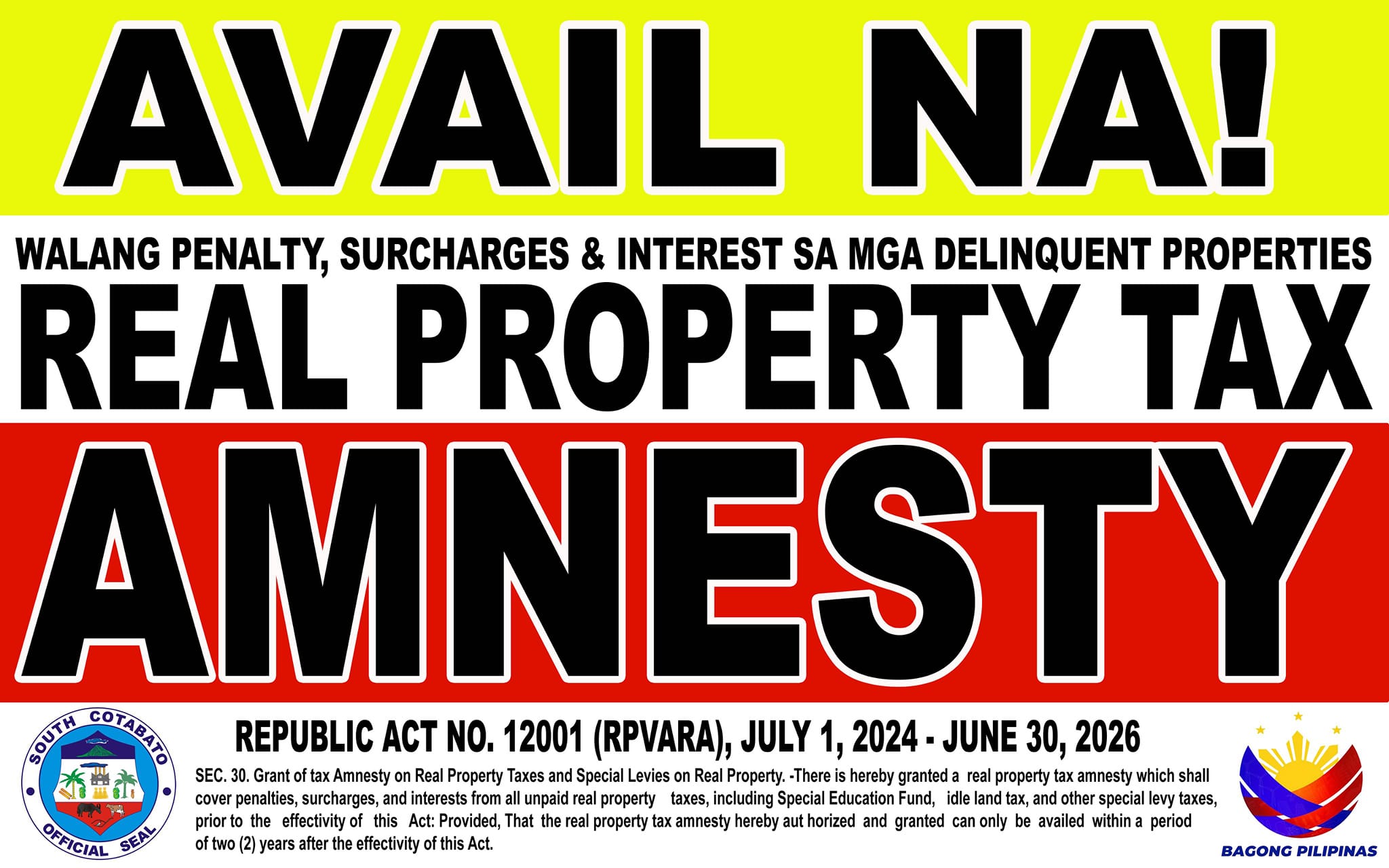

The Provincial Government of South Cotabato has announced a Real Property Tax Amnesty under Republic Act No. 12001 (RPVARA) in an effort to provide financial assistance to property owners and promote economic recovery. The amnesty program, which began on July 1, 2024, will continue until June 30, 2026, providing large benefits to people with outstanding property taxes.

The amnesty program waives all penalties, fees, and interest on delinquent real property taxes. This includes unpaid amounts from the Special Education Fund, idle land taxes, and other special levies incurred previous to the act’s introduction.

The two-year amnesty period is intended to encourage property owners to pay their taxes without suffering additional financial penalties. It intends to boost revenue collection for the province, which can then be spent in critical public services and infrastructure projects, as well as foster a more inclusive economic recovery by relieving the financial burden on both individuals and businesses.

Property owners are encouraged to take advantage of the amnesty period by contacting their local government offices or the South Cotabato Provincial Treasurer’s Office for assistance in clearing their debts. Officials have emphasized the simplicity of access to assistance and guidance throughout the process.

The Real Property Tax Amnesty is expected to boost the local economy by raising compliance rates and increasing provincial revenue. This proactive move demonstrates South Cotabato’s dedication to sustainable growth and financial stability for its citizens.

For additional information on the Real Property Tax Amnesty, property owners and interested parties can visit the Provincial Treasurer’s Office’s official Facebook page or phone them at (083) 228 2449.

T’nalak Festival 2025 prepares for “Pinaka Mabigat na Hayop” competition to boost livestock and poultry industry

KORONADAL CITY, South Cotabato— As part of the upcoming T’nalak...

Read More